IRS 1099-DIV 2024-2025 free printable template

Show details

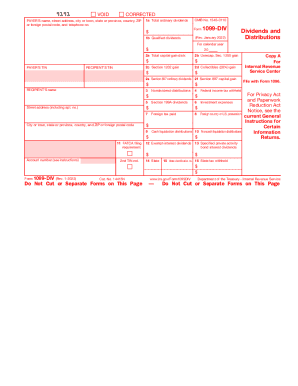

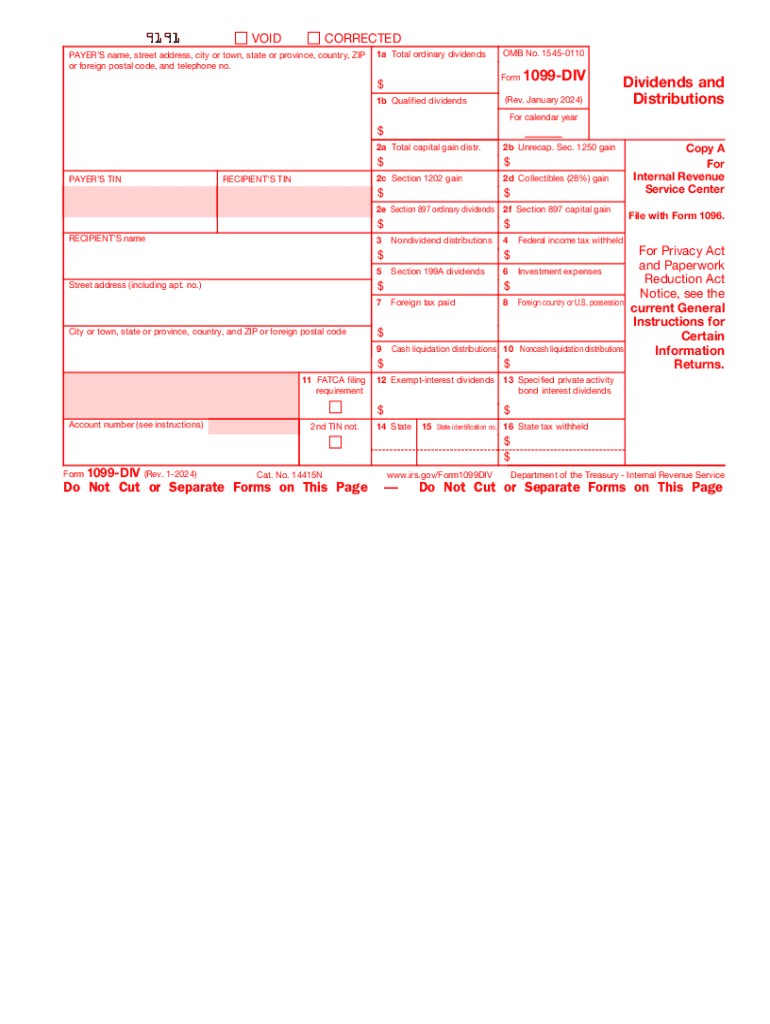

1a Total ordinary dividends OMB No. 1545-0110 Form 1b Qualified dividends 1099-DIV Rev. January 2022 Dividends and Distributions For calendar year PAYER S TIN RECIPIENT S TIN RECIPIENT S name 2a Total capital gain distr. 2b Unrecap. Sec. 1250 gain 2c Section 1202 gain 2d Collectibles 28 gain 2e Section 897 ordinary dividends 2f Section 897 capital gain Nondividend distributions Section 199A dividends Foreign tax paid City or town state or province country and ZIP or foreign postal code 11...

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS 1099-DIV

Step-by-step instructions for filling out the form

Instructions for filing the form

Understanding and Utilizing IRS 1099-DIV

The IRS 1099-DIV form is essential for taxpayers who receive dividends and distributions from investments. This form helps taxpayers report income accurately, ensuring compliance with federal tax regulations. Familiarity with its components can facilitate correct reporting and avoid potential penalties.

Step-by-step instructions for filling out the form

To properly complete the IRS 1099-DIV, follow these systematic steps:

01

Gather all necessary documentation, including statements from financial institutions that detail your dividends and distributions received throughout the tax year.

02

In Box 1a, report the total ordinary dividends received from your investments.

03

Box 1b should include any qualified dividends, which generally have lower tax rates.

04

Specify in Box 2 any capital gain distributions that may apply.

05

Complete the payer's and recipient's information accurately, ensuring names and taxpayer identification numbers (TINs) match IRS records.

06

Retain copies of the completed form for your records and distribute the necessary copies to recipients.

Instructions for filing the form

After completing the 1099-DIV:

01

File the form with the IRS by mail or electronically, depending on the number of forms you are submitting.

02

Ensure the form is sent to the correct submission address based on the state where your principal business is located.

03

Distribute the recipient copies by January 31st to comply with IRS deadlines.

Show more

Show less

Recent Developments Concerning IRS 1099-DIV

Recent Developments Concerning IRS 1099-DIV

This year, significant updates in tax laws have influenced the IRS 1099-DIV. Changes include a raised threshold for reporting certain dividends and modifications in how corporations handle dividend distributions. Stay aware of these amendments to ensure your filing is compliant and reflects the current tax landscape.

Essential Insights on IRS 1099-DIV: What You Need to Know

Defining IRS 1099-DIV

The purpose behind IRS 1099-DIV

Identifying who is required to complete this form

Conditions for form exemptions

Understanding the components of IRS 1099-DIV

Key filing deadlines for IRS 1099-DIV

Comparative analysis of IRS 1099-DIV with similar forms

Transactions that IRS 1099-DIV covers

Required copies for submission

Potential penalties for non-compliance with IRS 1099-DIV

Information needed to file IRS 1099-DIV

Supporting forms that accompany IRS 1099-DIV

Correct submission address for IRS 1099-DIV

Essential Insights on IRS 1099-DIV: What You Need to Know

Defining IRS 1099-DIV

The IRS 1099-DIV is a tax form that reports dividends and distributions received by individuals or entities from investments in stocks, mutual funds, or real estate investment trusts (REITs). It is essential for reporting income accurately for personal and business tax filings.

The purpose behind IRS 1099-DIV

The primary purpose of the IRS 1099-DIV is to ensure that income earned from investments is reported correctly, both by the recipient and by the IRS. This form helps the government track taxable income and assists taxpayers in determining their liabilities accurately.

Identifying who is required to complete this form

Anyone who receives dividends of $10 or more from investments must complete IRS 1099-DIV. This includes individual investors, partnerships, and certain organizations that hold investments with generating dividend income.

Conditions for form exemptions

Certain conditions exempt individuals or organizations from filing the IRS 1099-DIV:

01

If the total dividends received are less than $10 during the tax year, the form is not required.

02

Payers who are not obligated to report, such as certain small credit unions or non-profit organizations.

03

Dividends paid to certain foreign recipients typically fall outside of IRS requirements.

Understanding the components of IRS 1099-DIV

The form consists of multiple boxes that categorize different types of income:

01

Box 1a: Total ordinary dividends

02

Box 1b: Qualified dividends

03

Box 2: Total capital gain distributions

04

Box 3: Nondividend distributions

05

Box 4: Federal income tax withheld (if applicable)

Key filing deadlines for IRS 1099-DIV

The deadline to file the IRS 1099-DIV is typically February 28th if filing by mail and March 31st for electronic submissions. Ensure you adhere to these dates to avoid penalties and complications with your tax returns.

Comparative analysis of IRS 1099-DIV with similar forms

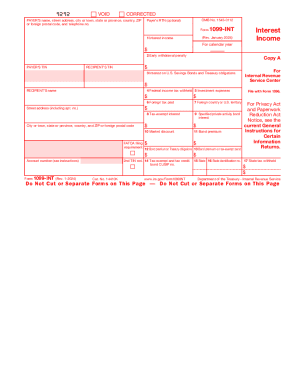

IRS 1099-DIV differs from other tax forms like the 1099-INT, which is used to report interest income. While both forms report income generated from financial assets, the 1099-DIV focuses specifically on dividends and distributions rather than interest earned from savings or bonds.

Transactions that IRS 1099-DIV covers

This form covers various transactions related to dividend payments and includes distributions from stocks, mutual funds, and REITs. Additionally, any capital gain distributions from mutual funds must also be reported using this form.

Required copies for submission

Taxpayers must distribute the IRS 1099-DIV form in three copies:

01

One copy for the recipient

02

One copy for the IRS

03

One copy for state tax authorities, if applicable

Potential penalties for non-compliance with IRS 1099-DIV

Failure to submit the 1099-DIV can lead to various penalties:

01

Failure to file by the deadline may incur fines starting at $50 per form.

02

Continued failure to file can escalate penalties up to $280 per form or more, depending on the lateness and circumstances.

03

Intentional disregard of the requirement can lead to more severe financial repercussions, including higher fines and potential legal action.

Information needed to file IRS 1099-DIV

Essential information required includes:

01

Payer's details (name, address, TIN)

02

Recipient's information (name, address, TIN)

03

The amounts paid, categorized appropriately in the relevant boxes

Supporting forms that accompany IRS 1099-DIV

Depending on the situation, certain taxpayers may also need to file additional forms along with the IRS 1099-DIV, such as:

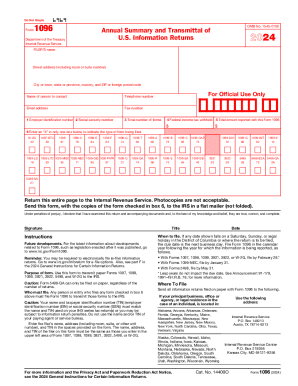

01

Form 1096: Annual Summary and Transmittal of U.S. Information Returns, if filing paper forms

02

State-specific forms to report income on your state tax return

Correct submission address for IRS 1099-DIV

Mail completed 1099-DIV forms to the appropriate IRS address, which varies based on the state in which the payer is located. Check the latest IRS guidelines to confirm the accurate mailing location.

By understanding the IRS 1099-DIV's complexities and ensuring timely and correct submission, taxpayers can simplify the filing process and minimize the risk of penalties. For tailored support and resources on tax form preparation, consider reaching out to a qualified professional or utilizing helpful platforms like pdfFiller today.

Show more

Show less

Try Risk Free